Birmingham has been named the worst city for bootleg cigarettes in the UK

Birmingham has been named the worst city for bootleg cigarettes in the UK after 120 packs were sold in only three days to undercover investigators in 48 shops.

Investigators from Philip Morris International, one of the world’s largest tobacco companies, were able to successfully buy the counterfeit products in a number of areas in the city, which included Sparkbrook, Sparkhill, Handsworth and Winson Green.

The test purchasers were able to procure the bootleg cigarettes in a number of shops and restaurants as well as a pet shop where the proprietors had hidden the cigarettes in clothes, store rooms and even behind skirting boards.

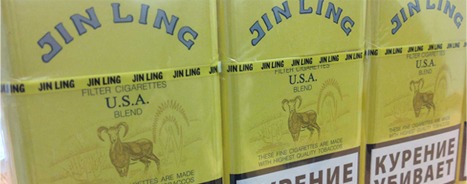

Both counterfeit packs from Russian, Chinese and Eastern European brands and contraband varieties of genuine international branded packs of the illicit products were found. Where counterfeit packs cost as little as 20 pence to produce, contraband is smuggled into the country without taxes or duty being paid on the product.

The test purchases were led by Will O’Reilly, former Detective Chief Inspector at Scotland Yard, who said that the illicit cigarettes could be obtained easily and the purchase could be initiated simply by inquiring about the availability of cheap packs from shopkeepers.

He added: “We saw some ingenious ways of hiding these cigarettes, but once they accepted that you were a buyer they were quite open about what they were doing.

“The motivation is clearly financial because they can make a small fortune from this. Some counterfeit packs are produced for as little as 20p per pack, but are then sold on for £2.50 or £3.50.

“The international brands smuggled in are sold for nearer £5 per pack, but it’s still much cheaper than what they should be sold for.

“As well as the dangers with what’s in the cigarettes themselves, there is also the very serious issue that the people buying them are helping to fund organised crime.

“A container ship filled with these can bring organised crime gangs up to £1 million. In turn, this represents a huge loss to the Treasury and for society.

“We have started to see that these criminal gangs are moving away from the importation of drugs and are moving instead onto the importation of illicit cigarettes, because of the high financial rewards and the comparatively low risks.”

A series of planned raids on 12 premises across Birmingham were conducted by the City Council’s Trading Standards Service in July which resulted in the seizure of cigarettes worth approximately £7,000.

On a related note, HM Revenue and Customs (HMRC) has revealed plans today to tackle some of the UK’s most notorious hotspots for the sale and supply of illicit tobacco and alcohol.

On a related note, HM Revenue and Customs (HMRC) has revealed plans today to tackle some of the UK’s most notorious hotspots for the sale and supply of illicit tobacco and alcohol.

Using the latest intelligence to identify high risk areas, HMRC officers will lead new inland enforcement operations in hotspot areas across the UK. These intensive bursts of activity will involve officers carrying out checks on shops, warehouses, self-storage sites, businesses and workplaces suspected of being used to sell, store, supply or distribute illicit tobacco and alcohol. Owners of premises where illicit goods are found face seizure of goods, fines, and a possible prosecution.

Working with partner agencies such as local police forces and trading standards departments, HMRC compliance officers will also visit businesses and people who should be registered for, or who aren’t paying the right amount of, tax or VAT.

Jennie Granger, HMRC’s Director General of Enforcement and Compliance, said:

“Tobacco and alcohol fraud costs taxpayers £3 billion in lost revenue each year, as well as breeding criminality and undermining honest, legitimate traders.

“This HMRC-led activity will bring together specialists from across a range of law enforcement agencies to identify and tackle the problem of illegal tobacco and alcohol in our communities targeting areas we know are hotspots of illicit activity.

“Anyone we catch who is involved in excise fraud can expect a wide-ranging response that can include the seizure of goods, being issued with a financial penalty and potentially a thorough investigation into all their tax affairs. We will also work closely with partner agencies and licensing authorities to ensure any businesses found selling illicit goods do not benefit from fraud.

“This activity shows how HMRC can and will track you down if you choose to break the rules.”

The new hotspot activity will take place during 2014 to 2015.